THE FASTEST AND

MOST RELIABLE

HARD MONEY LENDER.

CAPITAL FUNDING IS READY TO CLOSE

YOUR NEXT PROJECT.

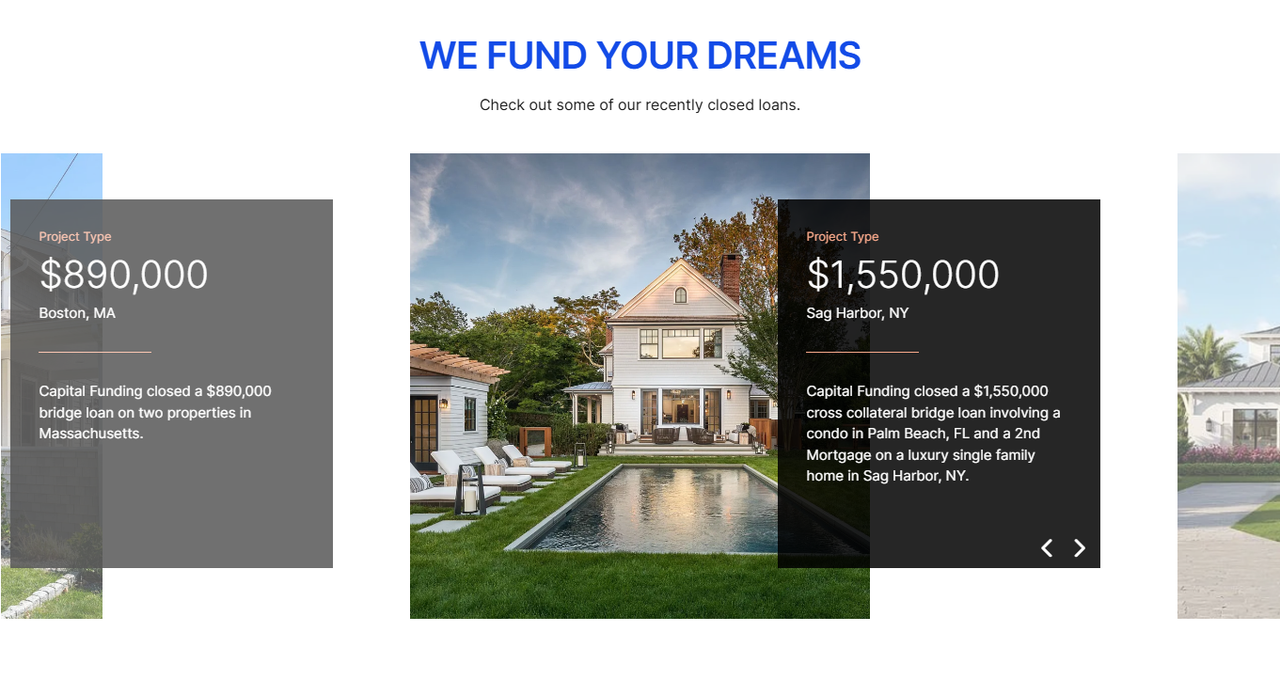

Capital Funding is a nationwide, direct private money lender specializing in fast and reliable closings for real estate investors. When traditional banks say no, Capital Funding offers the ability to close a hard money loan in just a few days. Capital Funding is backed by a family office with fully discretionary capital which is important in meeting deadlines & creative financing needs. Capital Funding offers both short term bridge loans and long-term financing at attractive rates. Our team of industry experts will work with you in ensuring your loan closes on time. We look forward to becoming your lending partner and investing in your next real estate project.

WHO WE ARE

While traditional bank closing times can span months and involve complex loan requirements, as a direct private lender, Capital Funding offers fast & reliable options to make sure you have access to capital when you need it. Capital Funding’s focus is on approving your private money loan in record time.

REAL ESTATE FINANCE PROGRAMS

We fund transactions nationwide, with a simple process and dedicated service.

What is a Hard Money Loan?

A Hard Money Loan is a short-term, asset-based loan secured by real estate. Unlike traditional bank loans, which are heavily focused on the borrower’s credit history, hard money loans are based primarily on the value of the property being used as collateral.

This type of loan is typically offered by a Private Lender rather than a bank or financial institution. It’s often used for projects where speed and flexibility are more critical than low interest rates.

Key Features of a Hard Money Loan:

Short-term duration (6–24 months)

Higher interest rates than conventional loans

Quick approval process

Collateral-based underwriting

Flexible terms

These characteristics make Hard Money Loans ideal for investors who need to close quickly or who may not qualify for traditional financing.

Who Uses Hard Money Loans?

Investors use hard money financing for a wide range of real estate strategies. Here are the most common use cases:

1. Fix and Flip Projects

Fix and Flip Lenders provide funding to investors who buy distressed properties, renovate them, and then sell them for a profit. These loans cover the purchase and often the rehab costs, making it easier for flippers to finance multiple projects at once.

2. Ground Up Construction Projects

A Ground Up Construction Lender specializes in funding new developments from scratch. Whether it’s a single-family home or a multi-unit complex, these lenders finance the construction and often provide interest-only payments during the build phase.

3. Bridge Loans for Real Estate

A Bridge Lender helps real estate investors bridge the gap between two transactions. For example, an investor may use a bridge loan to secure a new property while waiting to sell another. These short-term loans are perfect for time-sensitive opportunities.

Benefits of Using a Hard Money Lender

Working with a Hard Money Lender offers several advantages over conventional financing:

1. Speed

Hard money lenders can close in days, not weeks. In a competitive market, being able to act quickly gives investors a crucial edge.

2. Less Red Tape

Since Private Lenders focus on the value of the asset, the approval process involves far less paperwork and underwriting than bank loans.

3. Flexible Terms

From interest-only payments to custom repayment schedules, private lenders often tailor the loan to fit the project’s needs.

4. Credit Issues are Less Important

Hard money lenders are more concerned with the property’s potential than the borrower’s credit score. This makes it a viable option for investors with less-than-perfect credit.

5. Higher Leverage

In many cases, a Real Estate Investment Loan from a private lender can offer higher loan-to-value (LTV) ratios, allowing investors to put less money down.

What Makes a Good Hard Money Lender?

Choosing the right lender can make or break your investment strategy. Here are some traits of a trustworthy Hard Money Lender:

Experience in Real Estate – The lender should understand the real estate market, including trends and construction timelines.

Transparency – No hidden fees, and all terms should be clearly outlined.

Strong Track Record – Look for a lender with proven success and positive reviews.

Customer Support – Access to responsive and helpful staff is key when navigating real estate deals.

Speed and Reliability – The ability to close on time and fund quickly is essential.

Real Estate Investment Loans: A Strategic Tool

A Real Estate Investment Loan enables you to grow your portfolio faster. Whether you're flipping houses, building a multi-family complex, or investing in commercial property, hard money and bridge loans are strategic financial tools.

Types of Real Estate Investment Loans:

1. Acquisition Loans

Used for purchasing investment properties, these loans allow you to buy quickly, often with minimal documentation.

2. Rehab Loans

Cover the cost of renovations in a fix and flip project. These loans are disbursed in draws based on project milestones.

3. Construction Loans

Perfect for Ground Up Construction, these loans are often interest-only during the build, converting to a traditional loan upon completion.

4. Bridge Loans

Short-term loans used to bridge the gap between buying and selling properties. An ideal tool for real estate investors in transition.

When to Use a Private Lender

Private Lenders are best used in scenarios where speed, creativity, or project complexity makes traditional lending impractical. Here are a few examples:

You found a foreclosure auction property and need to close in 5 days.

Your project requires a custom funding structure.

You’re building a new development and need staged draws during construction.

You’re flipping multiple houses and want to leverage your capital across several projects.

You need a Bridge Loan to purchase a new property before selling your existing one.

Risks and How to Mitigate Them

As with any financing option, there are risks associated with Hard Money Loans:

1. Higher Interest Rates

The cost of capital is significantly higher than bank loans. You must ensure your project has a sufficient profit margin.

2. Shorter Terms

Most loans mature in 12 months, so proper planning is essential.

3. Default Risk

If the project fails and the loan cannot be repaid, the lender may foreclose on the property.

Mitigation Tips:

Work with experienced contractors and realtors.

Have a clear exit strategy (sell, refinance, or lease).

Perform a detailed market analysis before committing.

Always have a backup plan in case the timeline extends.

Why Work with Capital Funding?

If you're searching for a reliable Hard Money Lender, Fix and Flip Lender, or Ground Up Construction Lender, look no further than Capital Funding. Their team understands the fast-paced world of real estate and provides tailored financing solutions for every kind of investor.

Whether you're a seasoned developer or just starting your investment journey, Capital Funding offers a suite of loan products, including:

Their fast approvals, competitive terms, and commitment to client success have made them a preferred partner for thousands of real estate investors across the country.

Conclusion

Navigating the real estate investment world requires speed, flexibility, and the right financial partners. Traditional banks may offer low interest rates, but they often can’t keep up with the demands of an aggressive investment strategy.

That’s where a Hard Money Lender steps in.

With access to Private Lenders, investors can act quickly, fund complex projects, and scale their portfolios faster. Whether you need a Fix and Flip Lender, a Bridge Lender, or a Ground Up Construction Lender, hard money financing can unlock opportunities that traditional loans simply can’t.

To learn more and explore customized lending solutions, visit Capital Funding — your trusted partner for all types of Real Estate Investment Loans.